Global Perspectives

5 for 25: Trends Shaping Global Events, Trade, and Investment in 2025

As 2024 recedes into the memory, a decisive moment in global politics is upon us: Donald Trump will be returning to the White House on 20 January. Trump's return will transform U.S. domestic policy and reverberate through the international system by up-ending trade, investment, and geopolitical risk patterns. These changes will affect private capital investors, including those operating in small-state international finance centres (IFCs), who must gauge their response. They also provide the headline for five significant trends — Trump, Tariffs, Tax, Tech, and Trade - poised to take their place at the centre of the global investment stage through 2025 and beyond.

Trump: ‘America First’ And The Reconfiguring of Global Risk

The return of Donald Trump to the Presidency will herald a transformative pivot to a shifted global environment, now more nationalistic and protectionist. Trump's "America First" agenda - built upon the principles of rewriting trade deals, breaking away from international accords and placing U.S. interests ahead of multilateralism - will bring geopolitical risks and opportunities back to the forefront of the 2025 agenda.

Trump's presidency will make for a choppier investment environment for private capital investors. In his first term, we witnessed a transactional model of global relations manifested in trade wars, diplomatic tensions and bouts of financial volatility. If, in 2025, his policies are still focused on limiting foreign competition and combating global interdependence, investors should remain on guard for ripple effects.

On the upside, this political shift might be a boon for small-state IFCs. Countries with favourable tax policies, regulatory flexibility, and a track record of attracting capital in times of political instability will become ever more attractive to investors seeking safe harbours or alternative pathways into markets that are heavily impacted by shifts in U.S. policy.

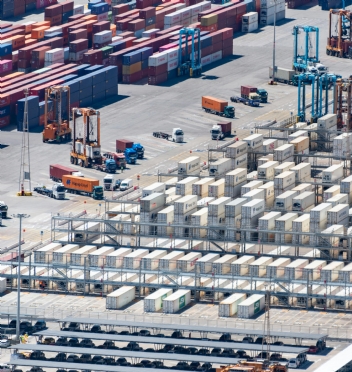

Tariffs: We Are Still In The Age of Protectionism And Supply Chain Shocks

One of Trump's most consequential legacies from his first term was his aggressive push to raise tariffs, including in his trade war with China. When he returns to office in 2025, tariffs will likely remain a significant tool of U.S. foreign policy. The immediate fallout will wash through international commerce, spanning matters as diverse as EVs, cell phones and agriculture, as Trump pursues more protectionist policies while limiting American reliance on foreign suppliers.

These developments will be a double-edged sword for small-state IFCs. Tariffs can disrupt global supply chains, rendering certain regions or industries less competitive and reorienting trade patterns. They can also boost inflation and prices in the short term, negatively impacting the cost of living. Still, investors could see new opportunities in jurisdictions playing a role as alternative manufacturing hubs or trade gateways. If manufacturing relocates, the investment that supports it will flow to the U.S., potentially via IFC conduits. Southeast Asian or African countries might also benefit as American companies seek to lessen their exposure to steep Chinese tariffs.

However, the spillover effects of tariffs - especially if they're directed at a vital sector, like technology - could include market turbulence and price hikes. Private capital investors must brace for supply chain disruptions in sectors reliant on Chinese or other global suppliers and diversify their portfolios to minimise the fallout. Companies examining ways to move production away from tariff-heavy markets for their cost-effectiveness and efficiency will be in demand. At the same time, small-state IFCs with strong capital management and deployment capabilities can play a key role in meeting the growing demand for new investment capital flows as production shifts to new locations.

Tax: The New Global Tax Order And Its Impact On Investment Flows

Seismic change is underway on the global tax front, and Trump's return will almost certainly challenge this process. Although the OECD's promotion of a global minimum tax rate of 15% has been a strong theme over the last several years, Trump's administration will likely re-examine the subject, particularly as he strives to keep U.S. businesses competitive internationally through a two-tier corporation tax system. Domestic 'Made in America' firms could benefit from a 15% CIT whilst foreign players may still have to bear the current 21% rate.

For small-state IFCs, Trump's return may elevate interest in jurisdictions that offer favourable tax regimes for multinational corporations, low or no tax rates on capital gains, and/or more benign tax-neutral regimes. Small-state IFCs are well placed to offer both a capital-friendly tax environment and a robust and rich financial infrastructure to attract and channel capital flows from investors.

But Trump's approach also risks forcing the U.S. into renegotiating tax treaties and pursuing more aggressive tax policies domestically. The great unknown is how markets will react to a perpetuation of the Tax Cuts and Jobs Act and a raft of new tax-cutting measures, adding to the steep tax cuts from the first Trump administration due to run out in 2025.

Much of the cuts, at least initially, will be funded by increased borrowing. Will the bond markets be prepared to bankroll the additional borrowing needed, given that the U.S. debt servicing is already set to exceed 6% of GDP? Interest payments will exceed military spending for the first time in U.S. history, and this will surely be a test for the mighty dollar.

Tech-tonics: Jump-starting Investment In Technology Will Raise Geopolitical Friction

With technology increasingly shaping the global economy, a China vs U.S. tech standoff will almost surely speed up the trend toward a technological decoupling of the two major global economies, one that will probably be most pronounced for China. The technological 'Cold War' that started during Trump's first term — focused on AI, 5G and semiconductors — will continue through 2025, altering the flow of global investment and the nature of innovation ecosystems.

The changes could create a unique opportunity for private investors to ride the tech-driven growth wave, especially in the future mega-sectors such as artificial intelligence, quantum computing, biotech and its supporting infrastructure. The geopolitical and market risks of tech investments will also increase. Corporate adoption still lags personal consumption (75% of all ChatGPT subscribers are personal) and investment to date of $1.5trn shows lots of promise but little by way of tangible near-term profits. AI remains an exciting but nascent and rapidly evolving technology that still has, for many, to prove its real-world impact.

Among the things to keep an eye on will be the rise of tech startups and venture capital in smaller-state IFCs. A proactive approach by jurisdictions such as Singapore and the Cayman Islands has made them attractive destinations for fintech, blockchain and other technologies. These smaller centres could strengthen their positions as key players in the global tech investment firmament amid geopolitical tensions.

Trade: Increasingly Regional, National And Protectionist

Global trade winds will blow differently in 2025, beset as they are by fractured trading blocs and regional alignments. Bilateral trade deals - instead of multilateral agreements - may take precedence, increasing export tensions between the West and other powers, including China and Russia. In this environment, the future of the WTO is not assured.

Disruption may open new avenues for small-state IFCs to play an intermediation role in leveraging regional trade agreements. Traditional financial systems might find it challenging to meet the needs of the new economy. The rise of digital trading hubs in smaller IFCs will be a boon for investors as these hubs are gaining traction in regions such as southeast ASIA, Africa and the Middle East, where emerging markets are making inroads into conventional trade routes.

2025 will also see further evolution in trade finance. The shift towards digitised trade and persistent political friction will drive demand for more secure, transparent trade finance solutions, which small-state IFCs are well-placed to offer. The remainder of this decade will be critical for the embedding and establishment of all things crypto, with the tailwinds of a supportive U.S. president and a more benign regulatory environment. Understanding how these new trade routes and financial instruments will develop will be a key to accessing growth areas in an increasingly fragmented global marketplace for private capital investors.

Wrap-Up: The Times They Are A-Changin'

2025 will be a year of significant change in global events, trade and investment. The re-entry of Donald Trump into the White House will bring back his brand of nationalism, protectionism and a more transactional approach to foreign relations, all of which will have significant implications for the shape of investment markets. Private capital investors, including those operating through small-state IFCs, will have to alter their strategies in a world redefined by geopolitical risk, technological disruption, and new tax and trade paradigms.

Small-state IFCs offer a unique blend of regulatory flexibility, tax advantages, relative political stability, and investment potential. These make them an attractive option for investors looking for alternatives to larger, more volatile markets. Still, private capital investors will need to know how to prosper in an altered world of Trump, Tariffs, Tax, 'Tech-tonics' and Trade.

Adaptability, foresight and strategic diversification will be the keys to success in 2025.

About our Blog

Global Perspectives provides regular, on-point commentary on relevant topics in a pithy and accessible way. Our observations and points of view are based on listening hard to clients global needs, priorities and concerns. We draw on insights from every area of our business and collaborate to deliver this global thinking; something that clients tell us is distinctive and sets us apart. If you'd like to find out more, please get in touch.

View our previous posts here.

About Mourant

Mourant is a law firm-led, professional services business with over 60 years' experience in the financial services sector. We advise on the laws of the British Virgin Islands, the Cayman Islands, Guernsey, Jersey and Luxembourg and provide specialist entity management, governance, regulatory and consulting services.

.jpg)