Guide

The Cayman Islands beneficial ownership regime

Contents of this guide

Introduction

What is the BOR?

Where is the BOR kept and who maintains it?

Are BORs public documents?

Which entities are required to establish a BOR?

What are the alternatives?

Regulated investment funds

SIBA registered persons

Who are the registrable beneficial owners?

What obligations are imposed on legal persons and beneficial owners?

Duties of legal persons

Duties of registrable beneficial owners

What information must be entered in the BOR?

Failure to comply with the BOR legislation

Restrictions notice

Statutory offences and penalties

Administrative fines

Who can access a BOR?

Contacts

Schedule

Breaches for which an administrative fine may be imposed

14 March 2025

Introduction

The Beneficial Ownership Transparency Act, 2023 (the Act) and the Beneficial Ownership Transparency Regulations, 2024 (the Regulations) came into force in the Cayman Islands on 31 July 2024, replacing and consolidating the previous beneficial ownership legislation which was found in multiple pieces of entity-specific legislation. The accompanying Guidance on Complying with the Beneficial Ownership Obligations in the Cayman Islands (the Guidance) published by the Competent Authority for Beneficial Ownership provides further guidance and clarification on the Act and the Regulations.

This Guide looks at the requirements of the Cayman Islands beneficial ownership regime (the Regime), the alternative routes to compliance available and the consequences of failing to maintain a beneficial ownership register (BOR) in accordance with the relevant legislation. It also highlights the key changes made by the Act and Regulations to the previous regime.

What is the BOR?

Entities falling within the definition of legal person under the Act are required to maintain a BOR of adequate, accurate and current beneficial ownership information containing the required particulars of 'registrable beneficial owners' in relation to the entity. There are, however, alternative routes to compliance for certain categories of legal person, which have replaced the previous 'exemptions' to maintaining a BOR and require reduced information as set out below.

Where is the BOR kept and who maintains it?

The corporate services provider (CSP) of the in-scope entity (usually the registered office provider) is required to establish and maintain the BOR at the registered office of the in-scope legal person in the Cayman Islands.

Are BORs public documents?

No, the BORs are not public documents. Currently, BOR information may only be searched by certain official bodies as described below in 'Who can access a BOR?'.

Which entities are required to establish a BOR?

The following Cayman Islands entities fall within the definition of legal person under the Act and must comply with the BOR requirements:

- companies, limited liability companies (LLCs) and foundation companies; and

- exempted limited partnerships, limited partnerships and limited liability partnerships (LLPs).

Previously, only companies, LLCs and LLPs were in scope of the BOR regime. Foreign companies and partnerships registered in the Cayman Islands in accordance with the Companies Act (as amended) or Exempted Limited Partnership Act (as amended) respectively do not fall within the definition of 'legal person' are therefore not in scope of the Regime.

A Cayman Islands entity falling within the definition of 'legal person' will need to comply with the obligation to identify and provide certain required information relating to its beneficial owners, unless an alternative route to compliance is available.

What are the alternatives?

The table below details the categories of legal person which may utilise an alternative route to compliance by providing their Cayman Islands CSP with written confirmation of their category and the required particulars specific to that category.

Category of legal person

Required particulars

An investment fund registered under the Mutual Funds Act (as amended) (the Mutual Funds Act) or the Private Funds Act (as amended) (the Private Funds Act)

The contact details of a person (the Contact Person) who is either a licensed fund administrator or other person licensed or registered with the Cayman Islands Monetary Authority (CIMA)

A legal person licensed under a regulatory law1

Identification of the regulatory law under which the legal person is licensed

A legal person listed on the Cayman Islands Stock Exchange or an approved stock exchange,2 or a subsidiary3 of such a listed entity

Name and jurisdiction of stock exchange and, where applicable, details of relationship to the listed entity

These alternative routes to compliance have replaced the previous 'exemptions' to maintaining a beneficial ownership register.

It should be noted that subsidiaries of licensed entities and regulated investment funds are not eligible to use an alternative route to compliance by virtue of their parent’s status. However, a subsidiary of a listed entity may be able to use the alternative route to compliance for listed entities if it falls with the applicable definition of a 'subsidiary' of a listed entity in the Act or is itself listed.

Regulated investment funds may opt to appoint a licensed fund administrator or another person located within the Cayman Islands who is licensed or registered with CIMA to act as the beneficial ownership Contact Person responsible for responding to any request for beneficial ownership information received from the Competent Authority.

The Contact Person will be required to provide the requested beneficial ownership information to the Competent Authority within 24 hours of a request being made, or such other timeframe as may be stipulated in the request.

The Guidance clarifies that the information which may be requested by the Competent Authority includes the beneficial ownership information that would be maintained on a BOR if the investment fund were not eligible for an alternative route to compliance. The Contact Person is not required to maintain the BOR or the beneficial ownership information for the legal person but must have access to such information to facilitate its role and be able to provide the Competent Authority with beneficial ownership Information within the relevant timeframe.

'Registered persons' under the Securities Investment Business Act (as amended), which were previously exempt from the requirement to provide beneficial ownership information, will not have an alternative route to compliance under the Act and will therefore be required to maintain a beneficial ownership register.

Who are the registrable beneficial owners?

As stated above, in-scope legal persons are required to identify their registrable beneficial owners and then obtain, provide to their CSP and keep current certain information containing the required particulars of those registrable beneficial owners.

Registrable beneficial owners include:

- any individual beneficial owner of the legal person; and

- any reportable legal entity:

- that directly holds a relevant interest in the legal person;

- otherwise exercises ultimate effective control over the management of the legal person; or

- through which any beneficial owner or reportable legal entity indirectly holds a relevant interest in the legal person.

Individual beneficial owners

An individual, including any deemed beneficial owner4, that meets one or more of the following conditions will be a beneficial owner:

- the individual ultimately owns or controls, whether through direct or indirect ownership or control (other than solely in the capacity of a professional advisor5 or professional manager6), 25% or more of the shares, voting rights or partnership interests in the legal person;

- the individual otherwise exercises ultimate effective control7 over the management of the legal person; or

- the individual is identified as exercising control of the entity through other means.

An individual will be a beneficial owner of a legal person indirectly if they have a majority stake8 in an entity which itself either (a) directly holds the shares, right or interest in the Cayman legal person or (b) is part of a chain of ownership where each entity in the chain holds a majority stake in the entity below it and the last entity in the chain holds the shares, right or interest in the Cayman legal person.

Where a trust meets one of the above conditions, a trustee of that trust must be identified as a contact person for beneficial ownership purposes.

Reportable legal entities

A reportable legal entity in relation to a legal person means another legal person (other than a foreign company, foreign entity or a foreign limited partnership) that if it were an individual would be a beneficial owner of the first mentioned legal person. There is no need to consider the ownership or control of a reportable legal entity.

Senior managing official

Where no registrable beneficial owner has been identified, a senior managing official9 of the legal person must be identified as the contact person for beneficial ownership purposes. The Guidance makes clear that where a senior managing official has been identified and listed on the BOR, they are listed as a contact person and not as a beneficial owner.

What obligations are imposed on legal persons and beneficial owners?

An in-scope legal person is required to identify every individual beneficial owner (including a trustee of any trust which meets the conditions for an individual beneficial owner) and every reportable legal entity (together, the registrable beneficial owners). Where no individual meets the definition of beneficial owner, the legal person is under a duty to provide the contact details of a senior managing official (as detailed above).

To do so, the legal person is required10 to give written notice to those individuals or entities which have been identified as registrable beneficial owners and to any individuals or entities whom the entity reasonably believes may be a registrable beneficial owner. That notice requires each addressee to respond within 30 days of receipt, confirming whether the individual or entity is a registrable beneficial owner and, if so, to confirm or correct any of the information required to be inserted in the BOR.

Each in-scope legal person is also under a duty to keep its BOR up to date and, where it becomes aware that there has been a 'relevant change' to the information contained in the BOR, must give notice as soon as reasonably practicable (and no later than 30 days after it becomes aware of the relevant change) to the registrable beneficial owner requesting confirmation of the change.

A relevant change occurs if:

- a registrable beneficial owner ceases to be a registrable beneficial owner in relation to the legal person; or

- any other change occurs as a result of which the 'required particulars' of a registrable beneficial owner in the legal person’s beneficial ownership register are incorrect, incomplete or not current. (See 'What information must be entered in the BOR?' below, noting that the registrable beneficial owner should proactively provide these updated particulars to the legal person).

The Guidance states that investment funds which do not have static registers (and trade on a monthly, weekly or even daily basis) will need to assess at what intervals its investors should be assessed with respect to a relevant change. Movements in shareholdings through subscriptions or redemptions may have an impact on who is assessed as a registrable beneficial owner. Where applicable, investment funds should therefore have procedures in place to be able to respond appropriately.

Duties of registrable beneficial owners

Where a registrable beneficial owner has not received a notice from the legal person as detailed above and has no reason to believe their details are already contained in the relevant BOR, the registrable beneficial owner is required to notify the legal person that they are a registrable beneficial owner and the date on which they became one, together with providing the required particulars.

Registrable beneficial owners are also required to notify the legal person of a relevant change to their beneficial ownership information within 30 days.

What information must be entered in the BOR?

The following required particulars for each registrable beneficial owner must be entered into the BOR:

Individual beneficial owner

Reportable legal entity

- full legal name

- residential address

- address for service of notices under the Act

- date of birth

- nationality/ies11

- the following information from the individual's unexpired and valid passport, driver's licence or other government-issued document:

- identifying number

- country of issue

- date of issue and expiry

- nature in which the individual owns or exercises control of the legal person

- the date on which the individual became or ceased to be a registrable beneficial owner in relation to the relevant legal person.

- corporate or firm name

- registered or principal office

- the legal form of the entity and the law by which it is governed

- the nature of the reportable legal entity’s ownership or its exercise of control of the legal person

- the register in which it is entered and its registration number in that register

- the date on which it became or ceased to be a registrable beneficial owner in relation to the relevant legal person.

Failure to comply with the BOR legislation

Where the CSP considers that the legal person has failed to comply with its duties (as set out above) without reasonable excuse or has made a statement that is false or misleading regarding beneficial ownership matters, the CSP is required to give notice to that legal person. Following receipt of such a notice, the legal person is required to provide the missing information and a justification or correction regarding any statement identified in the notice. If the legal person fails to provide any missing information within 30 days of receipt of such notice, the CSP may issue a restrictions notice to the legal person whose information is missing and must send a copy of the notice to the Competent Authority within 14 days of issuing it.

A restrictions notice may be withdrawn where the underlying obligation is complied with, there was a valid reason for failure to comply with a notice or where the rights of a third party in respect of the relevant interest are being unfairly affected by the restrictions notice.

The effect of a restrictions notice with respect to a relevant interest includes the following:

- any transfer or agreement to transfer the interests is void;

- no rights are exercisable in respect of the interest;

- no shares, interests or rights may be issued in respect of the interest; and

- except in a liquidation,

- no payment may be made of sums due from the legal person in respect of the interest;

- an agreement to transfer a right to be issued with any shares in respect of the relevant interest or a right to receive payment of any sums due from the legal person in respect of the relevant interest, is void.

Statutory offences and penalties

The Act includes the following offences and penalties (among others):

Offence

Penalty

Failure of legal persons to identify and/or give notice to registrable beneficial owners, together with failure to keep the BOR current

First offence - US$30,488

Second or subsequent offence - US$121,951

Third offence - Court may order the entity be struck from the Register

Failure to comply with notices (including knowingly or recklessly making a statement that is false)

On summary conviction:

- US$6,098 and/or 12 months' imprisonment

On conviction on indictment:

- First offence - US$30,488

Second or subsequent offence - US$60,976 and/or 2 years' imprisonment

Failure of a CSP to establish and maintain the BOR and review required particulars to ensure they are accurate and correct together with failure of the CSP to issue a restrictions notice (where applicable)

First offence - US$30,488

Second or subsequent offence - US$121,951

Failure of a registrable beneficial owner to supply information or to notify the legal person of relevant changes (including knowingly or recklessly making a statement that is false)

On summary conviction:

- US$6,098 and/or 12 months' imprisonment

On conviction on indictment:

- First offence - US$30,488

Second or subsequent offence - US$60,976 and/or 2 years' imprisonment

Conducting a search of a legal person’s BOR or disclosing confidential beneficial ownership information contrary to the Act

On summary conviction - US$6,098 and/or 12 months' imprisonment

Breach of a restrictions notice

On summary conviction - US$6,098.

Directors, managers, officers and partners of the legal person may also be liable to the same penalty as the entity.

The Registrar has the power to impose administrative fines on any person who breaches the beneficial ownership provisions of the BOR legislation. A breach does not have to be an offence under the applicable statute in order for an administrative fine to be imposed.

The initial administrative fine amount would be US$6,098. A further fine of US$1,220 is payable for each month that the breach continues, subject to a cap of US$30,488.

The Registrar may strike an in-scope entity off the Register if an administrative fine remains unpaid for 90 days.

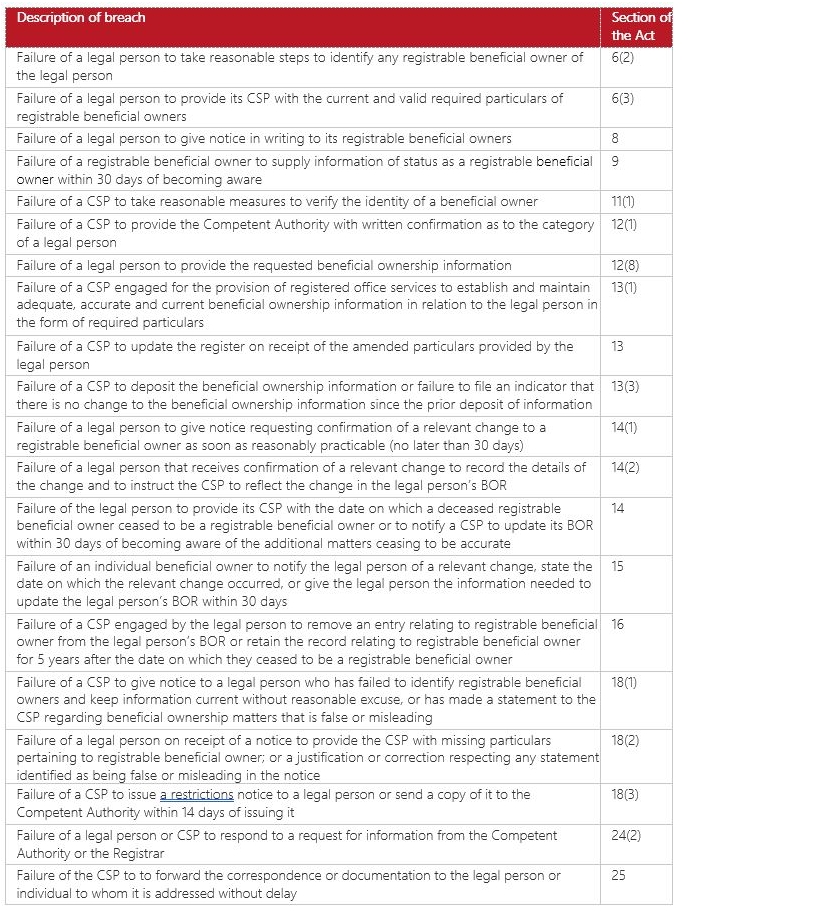

The breaches for which an administrative fine may be imposed include (among others):

- failure of the legal person to identify and give notice to registrable beneficial owners;

- failure of a registrable beneficial owner to supply beneficial ownership information within 30 days of becoming aware of the obligation to do so;

- failure of a legal person to provide its CSP with the current and valid required particulars of registrable beneficial owners;

- failure of CSP to provide written confirmation of the category of legal person;

- failure to give notice of any changes to registrable beneficial owners; and

- failure of a CSP to deposit the beneficial ownership information or failure to file an indicator that there is no change to the beneficial ownership information since the prior deposit of information.12

The full list of breaches for which an administrative fine may be levied can be found in the Schedule to this Guide. It is possible to appeal an administrative fine with the Competent Authority within 30 days of receipt.

Where a registrable beneficial owner's required particulars are not confirmed, identified or verified by the CSP and such entries are marked as 'pending' for more than 3 months, the legal person will be presumed to be in breach of the Act and administrative fines may be imposed by the Registrar.

Who can access a BOR?

Official bodies

The Cayman government has established a centralised electronic beneficial ownership registration platform (the Platform) to facilitate the unrestricted mutual exchange of beneficial ownership information between the respective law enforcement and tax authorities of the Cayman Islands and the United Kingdom. CSPs must upload the BOR information to the Platform on a monthly13 basis (at the minimum).

The Platform may be searched by the Competent Authority for the purposes of verifying the accuracy of the BOR information. The Competent Authority may also provide access to the BOR information on the Platform to the following bodies (among others):

- the Royal Cayman Islands Police Service;

- the Financial Reporting Authority;

- the Cayman Islands Monetary Authority;

- the Anti-Corruption Commission;

- the Tax Information Authority;

- the Maritime Authority of the Cayman Islands;

- the Civil Aviation Authority of the Cayman Islands;

- the Registrar of Lands;

- a licensed financial institution; and

- a designated non-financial business or profession (DNFBP) under the Anti-Money Laundering Regulations (as amended).

An annual fee of US$1,829 per user will be payable by any licensed financial institution or DNFBP for access to information on the Platform.

Public access

Restricted categories of members of the public (such as, journalists, academics, those working for civil society organisations or those seeking information in the context of a business relationship or transaction) may apply to access the beneficial ownership information of a legal person provided that can produce evidence of a legitimate interest in that information for the purpose of preventing, detecting, investigating, combating or prosecuting money laundering or terrorist financing. Where access is granted, the beneficial ownership information shared will be limited to:

- for an individual beneficial owner - name, country of residence, nationality, month or year of birth or both and nature of control; and

- for a reportable legal entity - name, registered office, legal form, registration number and nature of control.

Individual beneficial owners may apply for protection from such potential public disclosure of beneficial ownership information where they believe that their association with the legal person, if disclosed, would place them (or an individual living with them) at serious risk of kidnapping, extortion, violence, intimidation or other similar danger or serious harm. Where an application for protection from disclosure is approved, it will have effect for three years.

How can we help

Mourant's regulatory team are experts in advising clients on the Regime. For any assistance in understanding your legal obligations under the Act, or to query whether Mourant Governance Services (Cayman) Limited can provide a contact person for your CIMA-regulated fund, please reach out to your usual Mourant contact or to one of the contacts linked below.

Our Cayman Islands beneficial ownership regime – Steps guide is also available to help clients with Cayman Islands entities to determine whether they are required to report under the Regime and, if applicable, to assist in identifying the registrable beneficial owners of the relevant entity.

Contacts

A full list of contacts specialising in the Regime can be found here.

1 The definition of regulatory law includes the Banks and Trust Companies Act, the Companies Management Act, the Insurance Act, the Mutual Funds Act, the Private Funds Act and the Securities Investment Business Act (each as amended).

2 As listed at Schedule 4 to the Companies Act.

3 A legal person will be a subsidiary of a listed entity if (a) the listed entity holds 75% or more of the shares or voting rights in the subsidiary legal person, (b) the listed entity exercises ultimate effective control over the subsidiary legal person, or (c) the listed entity controls the subsidiary legal person by other means.

4 For the purposes of the Act, both natural persons and deemed beneficial owners are considered individuals. A deemed beneficial owner includes: (a) a corporation sole; (b) a government or government department of a country or territory or a part of a country or territory; (c) an international organisation whose members include two or more countries or territories (or their governments); and (d) a public authority.

5 Professional advisor includes a lawyer, an accountant or a financial advisor, who provides advice or direction in a professional capacity.

6 Professional manager includes a liquidator, a receiver or a restructuring officer who exercises a statutory function.

7 Ultimate effective control is defined as including ownership or control exercised through a chain of ownership or by means of control other than direct control.

8 A person or entity (A) holds a majority stake in a Cayman legal person (B) where (i) A holds a majority (ie, more than 50%) of the voting rights in B; (ii) A exercises ultimate effective control over the management of B; (iii) A is a member of B and alone controls a majority (ie, more than 50%) of the voting rights in B pursuant to a joint agreement with other shareholders or members; or (iv) A has the right to exercise, or actually exercise, dominant direct influence or control over B.

9 The term senior managing official includes a director or a chief executive officer of the legal person. In this regard, the FATF requires that, where no natural person is identified as a beneficial owner, the natural person who holds the position of senior managing official should be identified and recorded as holding this position (FATF Guidance on Transparency and Beneficial Ownership (Recommendations 24 & 25), paragraph 32). The Guidance provides useful clarification on how to determine who is the senior managing official for these purposes.

10 No notices are required where the legal person knows who the registrable beneficial owners are and has all required information.

11 This requires input of a single nationality only (notwithstanding that the relevant individual may hold more than one nationality). However, where a registrable beneficial owner holds more than one nationality, the Regulations require that this is indicated in the BOR. The Guidance also provides that the Competent Authority or Registrar may request information on additional nationalities using its information powers under section 24 of the Act.

12 The Registrar may reduce the administrative fine amount by 25% if the beneficial ownership information is deposited by the CSP within the timeframe specified by the Registrar.

13 This period is adjusted to every 90 days for entities in liquidation and to once a year for ordinary resident companies.

About Mourant

Mourant is a law firm-led, professional services business with over 60 years' experience in the financial services sector. We advise on the laws of the British Virgin Islands, the Cayman Islands, Guernsey, Jersey and Luxembourg and provide specialist entity management, governance, regulatory and consulting services.