Guide

Jersey Listed Funds

07 January 2025

A Listed Fund is a closed-ended Jersey company which falls within the definition of a collective investment fund for the purposes of the CIF Law and is listed on a stock exchange or market recognised by the JFSC. The Jersey Listed Fund Guide provides a streamlined process for authorising and establishing Listed Funds.

Following the implementation of the AIFMD in July 2013, regulations and codes apply in Jersey to AIFMs actively marketing funds in the EEA/UK.

Please refer to the Glossary at the end of this guide for the definitions of various capitalised terms.

Key features of a Listed Fund

- It must be a closed-ended Jersey company.

- It must be listed on a stock exchange recognised by the JFSC (see below for a list of these exchanges).

- Regardless of the number of potential investors to whom the fund is offered, a Fund Certificate is required in relation to a Listed Fund.

- Listed Funds must comply with the Certified Funds Code which sets out a regulatory framework of fundamental principles and practical guidance for all Certified Funds.

- Each of the Jersey Fund Service Providers must be registered under the FS Law and comply with the FSB Code.

- A Listed Fund which will be marketed in the EEA/UK and its Fund Service Providers must comply with the applicable sections of the AIF Code.

- The Listed Fund must have a Jersey-based manager or administrator that will conduct due diligence on the investment manager and monitor its actions.

- The investment manager must be appropriately qualified in accordance with published criteria (principally it must be established and regulated in an approved jurisdiction).

- Independent directors must form the majority of the board of directors of the Listed Fund and there must be at least two Jersey resident directors.

- Directors and certain other officers of Listed Funds and the Listed Fund's Fund Service Providers are required to seek confirmation that the JFSC has no objection to their appointment in relation to the Listed Fund by completing an application on the JFSC's myProfile system.

- Jersey tax-resident fund management companies (ie managers and investment managers, in the case of a Listed Fund) must satisfy the requirements of the Taxation (Companies - Economic Substance) (Jersey) Law 2019.

- Adequate arrangements must be made for the safe custody of the property of the fund. In the case of a hedge fund, the need for a custodian will be satisfied by the appointment of a prime broker with a credit rating of A1/P1.

- Flexibility is maintained, as the JFSC will discuss any variations from the requirements of the Jersey Listed Fund Guide on a case-by-case basis.

- A Listed Fund must be audited.

Investors in a Listed Fund

There is no restriction on the number or type of investors in a Listed Fund.

Authorisation process for a Listed Fund

In order to establish a Listed Fund, a standard application form is completed and filed with the JFSC, together with the relevant fees, a copy of the offer document and a declaration certifying that the Listed Fund complies with the requirements of the Jersey Listed Fund Guide.

The authorisation process will conclude with the issue of a Fund Certificate in relation to the Listed Fund and the registration under the FS Law of any Fund Service Providers not yet registered.

Fund Certificate

The Fund Certificate is granted to the fund itself if the fund is a company, to the general partner if the fund is a limited partnership or to the trustee if the fund is a unit trust. The majority of Fund Certificates have no conditions as conditions previously imposed on Listed Funds are now included within the Certified Funds Code.

Registration under the FS Law to carry on fund services business

Each Jersey Fund Service Provider of a Listed Fund needs to be registered under the FS Law to carry on fund services business.

All registered Fund Service Providers are required to comply with the FSB Code which consists of eight core principles together with detailed requirements in respect of each of these principles. However, Managed Entities acting in relation only to expert funds, related expert funds or materially equivalent funds are subject only to the core principles and a set of standard conditions attaching to their registration under the FS Law unless they have elected to comply with the FSB Code in full.

Once a person (other than a Managed Entity) is registered to provide fund services business of the relevant type, it does not need to apply for authorisation in relation to each new fund for which it intends to carry on the same type of fund services business.

Changes made to a Listed Fund do not require the prior approval of the JFSC provided the criteria in the Jersey Listed Fund Guide continue to be met.

AIF Regulations

In relation to Listed Funds that will be marketed in the EEA/UK:

- there is no requirement to obtain a certificate pursuant to the AIF Regulations provided the JFSC is notified and gives its written permission for the Listed Fund to be marketed in the EEA/UK; and

- its Fund Service Providers may seek an exemption from the requirement to register for AIFSB if AIFM functions are included within the classes of business on their FSB registration.

The Listed Fund must comply with the applicable sections of the AIF Code. These sections mirror the Transparency and Asset Stripping provisions of Chapters IV and V of the AIFMD.

Timescale for authorisation

The JFSC's published timescale for authorising a Listed Fund is three working days (subject to prior FSB approval) and 30 working days for the FSB registration of any unregistered Fund Service Providers.

These timescales are based on the JFSC receiving a fully completed application and satisfactory responses to enquiries.

Statutory fees

Application fees

A fee of £3,719 is payable on application for the Fund Certificate plus £3,719 in respect of each of the fund's Jersey Fund Service Providers.

Annual fees

Annual fees are payable in relation to a fund which holds a Fund Certificate. The amount depends on the total number of pools of assets in the fund at the time the fee is payable (this ranges from £6,140 if there is only one pool of assets to £60,417 if there are 200 or more pools of assets).

Statutory fees are also payable by Jersey Fund Service Providers. A fee of £4,606 is payable for a Fund Service Provider's application for registration under the FS Law. Please note that as mentioned above, once a Fund Service Provider is registered, then if it is not a Managed Entity, it does not need to apply for authorisation in relation to each new fund for which it intends to carry on the same type of fund services business. The annual fees payable by a Fund Service Provider depend on the number of pools of assets in all the collective investment funds in relation to which it is a Fund Service Provider. This ranges from £7,654 to £72,322. A Fund Service Provider is required to pay the minimum annual fee of £7,654 even if the number of pools of assets in all the collective investment funds in relation to which it carries on fund services business is zero.

If the Fund Certificate is granted or the Fund Service Provider registered on a day other than 1 January 2025, the annual fees shall be 1/12th of the amount specified for each complete month to 1 January 2026.

Offer document

The Jersey Listed Fund Guide contains requirements for a Listed Fund's offer document, which include the requirement that the offer document must comply with the CFPO. These requirements are not onerous and would usually be addressed in a well-drafted offer document prepared in compliance with the relevant listing rules. There is an over-arching requirement that the offer document must contain any material information that investors would reasonably require to enable them to make an informed judgement about the merits of participating in the fund.

Offer documents for Listed Funds need to include the required form of investment warning (although there is no need for investors to sign a copy of the investment warning).

In addition, if the Listed Fund will be marketed in the EEA/UK , it must comply with the disclosure requirements of the AIF Code.

Additional requirements in relation to sustainable investments (ie investments which contribute to either an environmental or social objective) were introduced on 15 July 2021. When a Listed Fund is marketed on the basis of investing in a sustainable investment, it must disclose all material information in relation to the sustainable investment strategy and objectives.

What if a Listed Fund does not meet the criteria?

We have experience in successfully negotiating variations from certain requirements of the Jersey Listed Fund Guide where the JFSC has been satisfied in respect of the appropriateness of the particular scheme. For example, the JFSC has demonstrated a willingness to approve applications on behalf of Listed Funds whose investment manager or adviser is unable to comply with the criteria if the JFSC can be satisfied as to the ability of the investment manager or adviser to fulfil its functions in relation to the Listed Fund.

Alternatively, the traditional regime for the authorisation of a public fund continues to exist for anyone wishing to establish a fund via that route.

A separate Mourant guide on Public Funds is available.

Recognised stock exchanges and markets

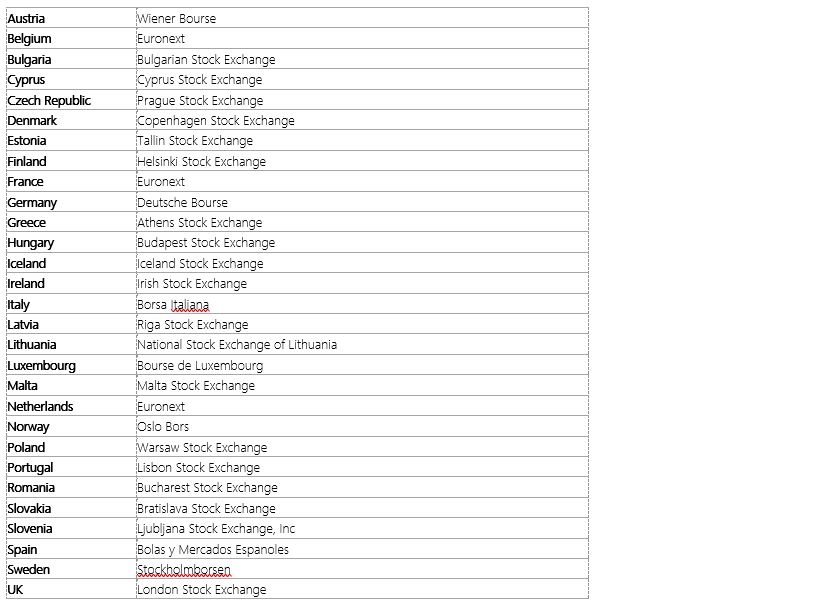

Stock exchanges of EU countries and members of the European Free Trade Association who have ratified the EEA Agreement (Iceland, Liechtenstein and Norway):

Stock exchanges recognised by the UK Financial Services Authority as:

Recognised Investment Exchanges

- London Stock Exchange plc

Recognised Overseas Investment Exchanges

- National Association of Securities Dealers Automated Quotations (NASDAQ)

- The Swiss Stock Exchange (SWX)

Designated Investment Exchanges

- American Stock Exchange

- Australian Stock Exchange

- Bermuda Stock Exchange

- Bolsa Mexicana de Valores

- Bourse de Montreal Inc

- Chicago Stock Exchange

- Hong Kong Exchanges and Clearing Limited

- The International Stock Exchange

- Johannesburg Stock Exchange

- Korea Stock Exchange

- New York Stock Exchange

- New Zealand Stock Exchange

- Osaka Securities Exchange

- Pacific Exchange

- Philadelphia Stock Exchange

- Singapore Exchange

- Tokyo Stock Exchange

- Toronto Stock Exchange

Other stock exchanges or markets nominated by Jersey Finance Limited and recognised by the JFSC for the purposes of the Jersey Listed Fund Guide

- Alternative Investment Market (AIM)

- Mauritius Stock Exchange (Official Market)

- Specialist Fund Market

A copy of the Jersey Listed Fund Guide is available at www.jerseyfsc.org.

Glossary

AIF an alternative investment fund as defined in the AIF Regulations.

AIF Code the Code of Practice for Alternative Investment Funds and AIFSB issued by the JFSC.

AIF Regulations the Alternative Investment Funds (Jersey) Regulations 2012.

AIFM a manager of one or more AIFs.

AIFMD the European Union's Alternative Investment Fund Managers Directive.

AIFSB a person carries on AIF services business if its regular business is managing one or more AIFs.

Certified Fund a fund in relation to which a Fund Certificate has been issued.

Certified Funds Code the Code of Practice for Certified Funds issued by the JFSC.

CFPO the Collective Investment Funds (Certified Funds – Prospectuses) (Jersey) Order 2012.

CIF Law the Collective Investment Funds (Jersey) Law 1988.

COBO the Control of Borrowing (Jersey) Order 1958.

EEA the European Economic Area.

FS Law the Financial Services (Jersey) Law 1998.

FSB Code the Code of Practice for Fund Services Business issued by the JFSC.

Fund Certificate a certificate issued by the JFSC pursuant to the CIF Law.

Fund Service Provider a person who carries on fund services business within the meaning of the FS Law, which would include any of the following:

- a manager, manager of a managed entity, administrator, registrar, investment manager, or investment adviser;

- a distributor, subscription agent, redemption agent, premium receiving agent, policy proceeds paying agent, purchase agent, or repurchase agent;

- a trustee, custodian, or depositary; or

- a member (except a limited partner) of a partnership, including a partnership constituted under the law of a country outside Jersey.

JFSC the Jersey Financial Services Commission.

Managed Entity broadly, a Fund Service Provider who is managed or administered by a third party service provider in the Island under the supervision of a board (usually of non-executive directors).

Contacts

For further information in relation to this subject matter, please contact one of our industry leading experts. A full list of our senior funds team can be found on our website.

About Mourant

Mourant is a law firm-led, professional services business with over 60 years' experience in the financial services sector. We advise on the laws of the British Virgin Islands, the Cayman Islands, Guernsey, Jersey and Luxembourg and provide specialist entity management, governance, regulatory and consulting services.