Guide

An introduction to Jersey investment funds

07 January 2025

This guide is a general introduction to the range of Jersey investment funds, both regulated and unregulated, and is not intended to provide a full summary of or commentary on the provisions of Jersey law but to identify features likely to be of general interest. Separate guides dealing with each type of Jersey fund are available.

Please refer to the Glossary at the end of this guide for the definitions of various capitalised terms.

Introduction

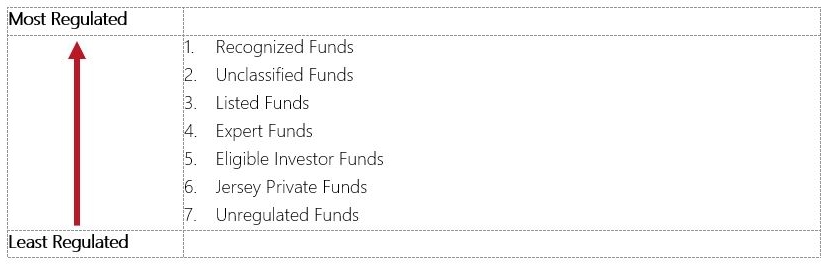

Jersey offers a full spectrum of fund regulation, from highly regulated recognized funds which may be marketed widely to the general public to unregulated funds which fulfil certain criteria and therefore may opt out of regulation as a fund in Jersey:

Types of fund vehicle

Jersey funds may be established as unit trusts, limited partnerships, separate limited partnerships, incorporated limited partnerships, limited liability partnerships, companies, protected cell companies, incorporated cell companies and limited liability companies. Limited liability partnerships and limited liability companies, however, cannot be collective investment funds for the purposes of Jersey law. With the exception of Listed Funds (which must be closed-ended), funds may be open or closed-ended.

Fund regulation

The Jersey financial services regulator, the JFSC, uses its regulatory powers to protect investors and to maintain the Island's reputation. The criteria for granting approval and the manner in which the fund will be regulated largely depend on whether the fund is private or public and whether it is open or closed-ended. In particular, a light regulatory touch is applied in the case of funds created for the benefit of sophisticated or institutional investors or where the fund has a high minimum level of investment, provided that the appropriate risk warnings are included in the offer document.

Jersey-based fund service providers (other than functionaries of Recognized Funds which are regulated under the CIF Law) must be registered under the FS Law to conduct fund services business. All registered Fund Service Providers must comply with the FSB Code although managed entities acting only in relation to expert funds or materially equivalent funds are subject only to the core principles unless they elect to follow the FSB Code in full. All Certified Funds (which includes Expert, Eligible Investor, Listed and Unclassified Funds) are subject to the Certified Funds Code which applies to the activities of the fund itself.

Following the implementation of the AIFMD in July 2013, regulations and codes apply in Jersey to AIFMs actively marketing funds in the EEA/UK. Funds marketing outside the EEA/UK are unaffected as long as they do not have an EEA/UK AIFM.

Types of fund

Recognized Funds are collective investment funds that have been granted a recognized fund certificate under the Collective Investment Funds (Recognized Funds) (Rules) (Jersey) Order 2003.

They are the most highly-regulated funds in Jersey and their functionaries are regulated under the CIF Law (rather than the FS Law).

Unclassified Funds are funds that are offered to more than 50 investors or are listed and do not fall within the definition of a Recognized Fund or the simplified regulatory regimes for Listed, Expert or Eligible Investor Funds. Unclassified Funds are Certified Funds and are suitable structures for public offerings. They are governed by the CIF Law and the promoters of such funds must comply with the JFSC's promoter policy.

Unclassified Funds which are open-ended and offered to the general public must comply with the OCIF Guide. The JFSC expects Unclassified Funds aimed at more sophisticated investors but which would not be classed as Listed, Expert or Eligible Investor Funds to be aligned with the OCIF Guide so far as possible unless application of the OCIF Guide requirements is not feasible or is inappropriate in light of the nature of the fund and its target investors.

Unclassified Funds must have a Jersey-based manager and, for open-ended funds, a Jersey-based custodian.

The prospectuses for all Unclassified Funds whether open or closed-ended and whether structured as companies, unit trusts or limited partnerships, must comply with the CFPO. If the Unclassified Funds will be marketed in the EEA/UK, their prospectuses must also comply with the disclosure requirements of the AIF Code.

Closed-ended corporate funds which are to be listed on a recognized stock exchange or market may take advantage of a streamlined authorisation process. The Jersey Listed Fund Guide issued by the JFSC sets out the characteristics of a Listed Fund. There is no minimum investment level and no restriction on the number or type of investor.

Listed Funds are Certified Funds which must have at least two Jersey resident directors and a Jersey-based manager or administrator to monitor the fund in line with the Listed Fund Guide.

The information that must be included in a Listed Fund's offer document (including the specified form of investment warning) is set out in the Jersey Listed Fund Guide. In addition, a Listed Fund's offer document must comply with the CFPO and, if the Listed Fund will be marketed in the EEA/UK, the disclosure requirements of the AIF Code.

A fast-track authorisation process is also available for the establishment of funds which target Expert Investors (as defined in the Jersey Expert Fund Guide issued by the JFSC and includes institutional and sophisticated investors or any person investing at least US$100,000 (or its currency equivalent)). An Expert Fund may be open or closed-ended and can be offered to an unlimited number of investors (providing all such investors qualify as expert investors which they must expressly acknowledge).

Expert Funds are Certified Funds and must have at least two Jersey resident directors for the fund company, trustee (for unit trusts) or general partner (for limited partnerships). The fund company, general partner or trustee (as appropriate) must be established in Jersey and all Expert Funds must have a Jersey-based administrator, manager, or (in the case of a unit trust) trustee.

The information that must be included in an Expert Fund's offer document (including the specified form of investment warning to be acknowledged in writing by investors) is set out in the Jersey Expert Fund Guide. In addition, an Expert Fund's offer document must comply with the CFPO and, if the Expert Fund will be marketed in the EEA/UK, the disclosure requirements of the AIF Code.

A fund which is suitable for Eligible Investors (essentially professional or experienced investors) and which can be authorised on a fast-track basis provided it fulfils the criteria of the Jersey Eligible Investor Fund Guide issued by the JFSC.

Eligible Investor Funds are alternative investment funds as defined by the AIF Regulations, and they are also Certified Funds. The fund company, general partner or trustee (as appropriate) must be established in Jersey and have at least two Jersey resident directors.

The information that must be included in an Eligible Investor Fund's offer document (including the specified form of investment warning) is set out in the Jersey Eligible Investor Fund Guide. An Eligible Investor Fund's offer document is not required to comply with the CFPO but must comply with the disclosure requirements of the AIF Code.

The JPF regime provides a streamlined fast-track regulatory authorisation process for the establishment of funds marketed to 50 or fewer professional or eligible investors, as defined in the Jersey Private Fund Guide issued by the JFSC.

A JPF may be open or closed-ended provided that the 50 or fewer test (within the meaning of the Jersey Private Fund Guide) is met.

A JPF must appoint a designated service provider which is registered under the FS Law.

Whilst there is no explicit requirement for the governing body and management and control of a JPF to be in Jersey, the JFSC's expectation is for at least one or more Jersey resident directors to be appointed to the board of a JPF or its governing body.

All investors must acknowledge in writing receipt of an investment warning and disclosure statement and an offer document is only required if the JPF is an AIF, in which case, the AIFMD legislation and AIF Code will also apply.

Unregulated Funds may be open or closed-ended and may only be offered to eligible investors which includes professional or institutional investors or investors who make a minimum initial investment of US$1,000,000 (or its currency equivalent).

A simple filing of a notice with the JFSC listing certain basic features and declaring that the fund qualifies as an Unregulated Fund at the same time as the establishment of the fund vehicle is the only process required to take a fund outside the application of the CIF Law and the FS Law.

Prominent investor warnings must be included in the offer document and acknowledged in writing by prospective investors.

Unregulated Funds cannot be marketed in the EEA.

Glossary

AIF an alternative investment fund as defined in the AIF Regulations.

AIF Code the Code of Practice for Alternative Investment Funds and AIFSB issued by the JFSC.

AIF Regulations the Alternative Investment Funds (Jersey) Regulations 2012.

AIFM a manager of one or more AIFs.

AIFMD the European Union's Alternative Investment Fund Managers Directive.

AIFSB a person carries on AIF services business if its regular business is managing one or more AIFs.

Certified Fund a fund in relation to which a Fund Certificate has been issued.

Certified Funds Code the Code of Practice for Certified Funds issued by the JFSC.

CFPO the Collective Investment Funds (Certified Funds - Prospectuses) (Jersey) Order 2012.

CIF Law the Collective Investment Funds (Jersey) Law 1988.

EEA the European Economic Area.

FS Law the Financial Services (Jersey) Law 1998.

FSB Code the Code of Practice for Fund Services Business issued by the JFSC.

Fund Certificate a certificate issued by the JFSC pursuant to the CIF Law.

JFSC the Jersey Financial Services Commission.

JPF Jersey Private Fund

OCIF Guide the guide issued by the JFSC setting out the conditions applicable to Jersey open-ended collective investment funds offered to the general public.

Contacts

For further information in relation to this subject matter, please contact one of our industry leading experts. A full list of our senior funds team can be found on our website.

About Mourant

Mourant is a law firm-led, professional services business with over 60 years' experience in the financial services sector. We advise on the laws of the British Virgin Islands, the Cayman Islands, Guernsey, Jersey and Luxembourg and provide specialist entity management, governance, regulatory and consulting services.